#AAPL (Apple Inc.). Exchange rate and online charts

Currency converter

20 Mar 2025 20:11

(-8.38%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

Apple Inc. is the American IT-giant and the most expensive company in the world. Its capitalization exceeds $450 billion and the brand value according to different estimates reaches $98 to $185 billion. The company was established in early 70’s in California by Steve Jobs and Steve Wozniak, and first registered on April 1, 1976. The IPO was launched on December 12, 1980. In total, 4.6 bln securities were sold at the initial cost of $3.6. Until 2004 the share price did not go over $40. However, after the company refocused on the mobile devices, the share price has multiplied by 6 times. Moreover, after the release of the iPad, the shares of Apple Inc. surged to the mark of $700. Now the asset turnover is about 900 billion and the unit price fluctuates around $500.

Apple Inc. share price has been growing by approximately 16.1% for the last three years. The dividend yield equals 2.23% and EPS 42% a year. Cost of securities is directly bound to the quarterly reports and new devices releases. The main income of Apple Inc. is constituted by expanding iPhone sales, which comprise about 67% of gross income. Consequently, the company’s share value is much influenced by the success of new Apple smartphones.

See Also

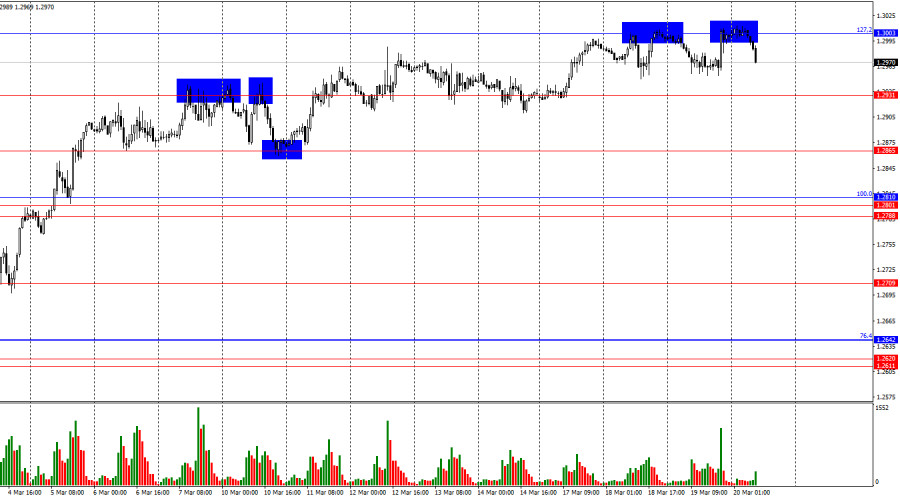

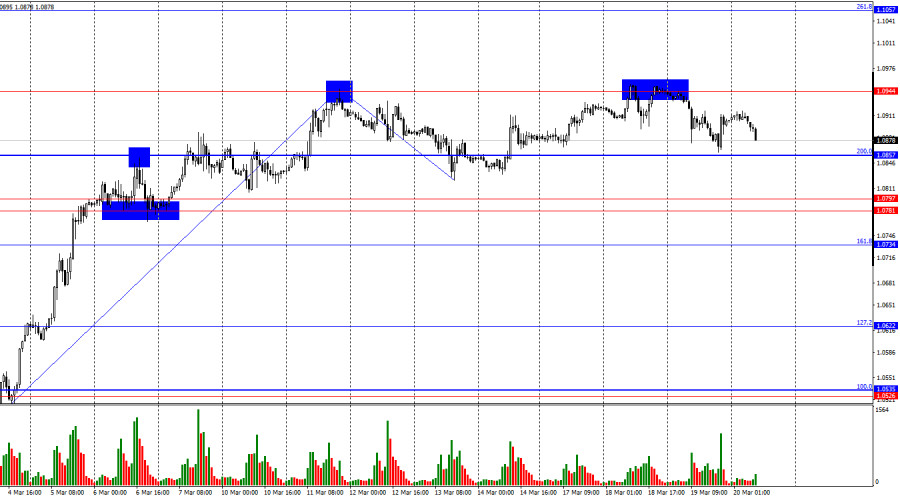

- Bearish traders are awaiting support from the Fed and the Bank of England

Author: Samir Klishi

11:36 2025-03-20 UTC+2

1930

The Japanese yen maintains its bullish bias, driven by expectations that the Bank of Japan will continue raising interest rates this year.Author: Irina Yanina

11:31 2025-03-20 UTC+2

1930

Bulls have been attacking for two weeks, but it's time for a pauseAuthor: Samir Klishi

11:41 2025-03-20 UTC+2

1915

- Although the S&P 500 shows optimism, its growth since March 14 has been viewed as more of a correction.

Author: Ekaterina Kiseleva

12:26 2025-03-20 UTC+2

1900

Gold is experiencing a slight decline after reaching a new all-time high, remaining in a defensive stance.Author: Irina Yanina

11:29 2025-03-20 UTC+2

1780

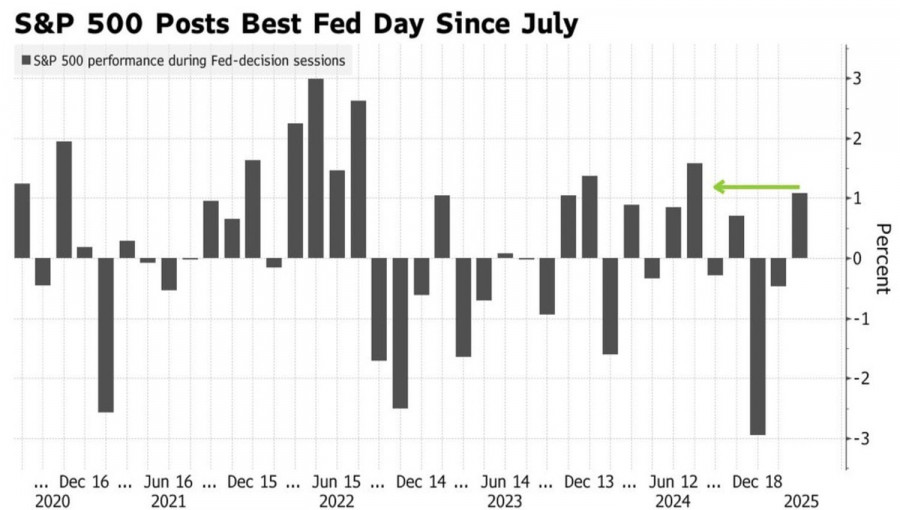

US stock markets close strongly higher: S&P 500 gains 1.1%, Nasdaq 100 up 1.41%Author: Jakub Novak

10:30 2025-03-20 UTC+2

1690

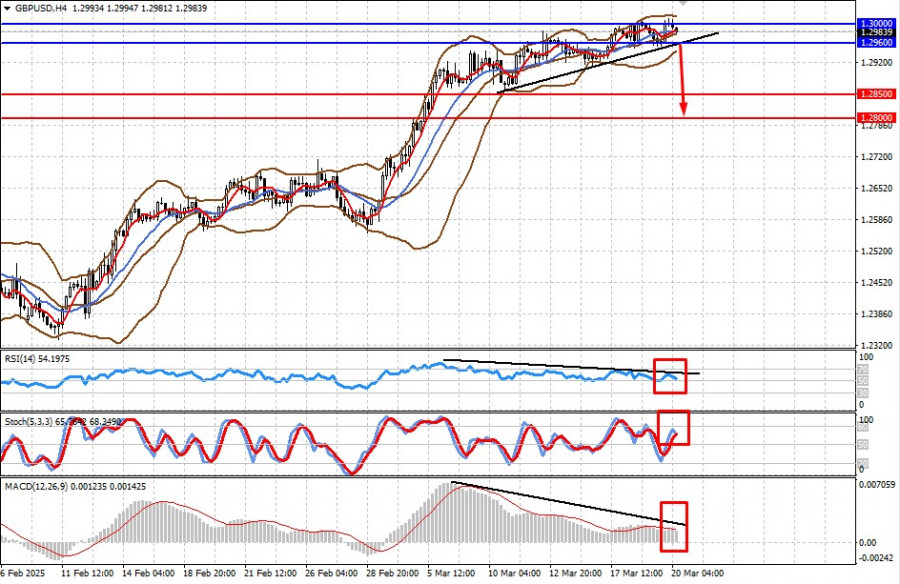

- GBP/USD: Pound Losing Significant Bullish Momentum

Author: Pati Gani

11:25 2025-03-20 UTC+2

1690

Overview for March 20Author: Jozef Kovach

12:19 2025-03-20 UTC+2

1675

Jerome Powell reassured investors that the central bank has everything under control, which pleased S&P 500 bullsAuthor: Marek Petkovich

10:05 2025-03-20 UTC+2

1645

- Bearish traders are awaiting support from the Fed and the Bank of England

Author: Samir Klishi

11:36 2025-03-20 UTC+2

1930

- The Japanese yen maintains its bullish bias, driven by expectations that the Bank of Japan will continue raising interest rates this year.

Author: Irina Yanina

11:31 2025-03-20 UTC+2

1930

- Bulls have been attacking for two weeks, but it's time for a pause

Author: Samir Klishi

11:41 2025-03-20 UTC+2

1915

- Although the S&P 500 shows optimism, its growth since March 14 has been viewed as more of a correction.

Author: Ekaterina Kiseleva

12:26 2025-03-20 UTC+2

1900

- Gold is experiencing a slight decline after reaching a new all-time high, remaining in a defensive stance.

Author: Irina Yanina

11:29 2025-03-20 UTC+2

1780

- US stock markets close strongly higher: S&P 500 gains 1.1%, Nasdaq 100 up 1.41%

Author: Jakub Novak

10:30 2025-03-20 UTC+2

1690

- GBP/USD: Pound Losing Significant Bullish Momentum

Author: Pati Gani

11:25 2025-03-20 UTC+2

1690

- Jerome Powell reassured investors that the central bank has everything under control, which pleased S&P 500 bulls

Author: Marek Petkovich

10:05 2025-03-20 UTC+2

1645