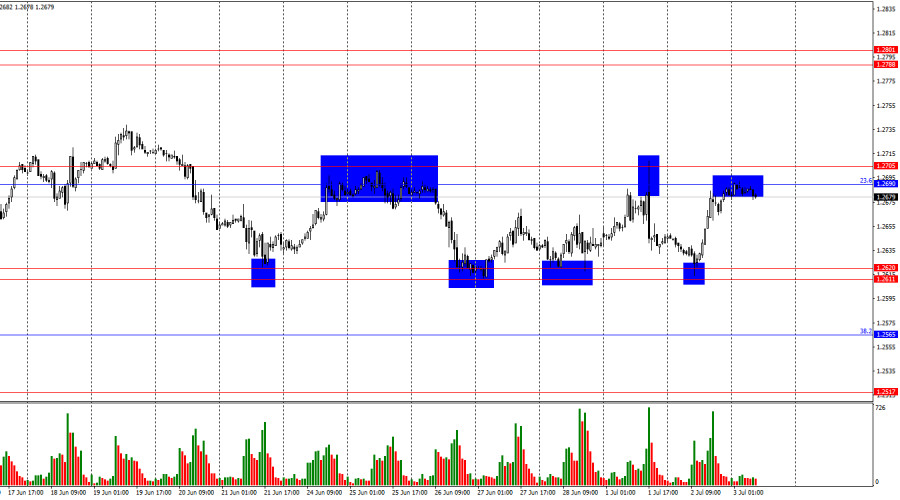

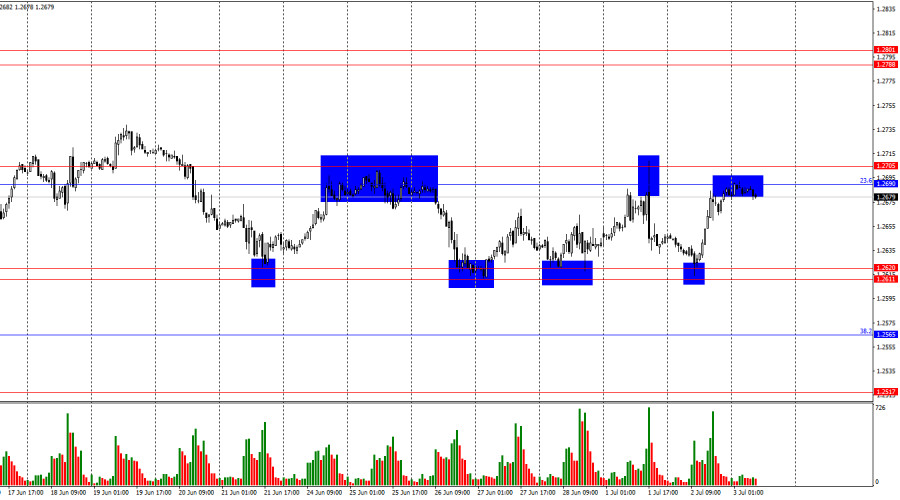

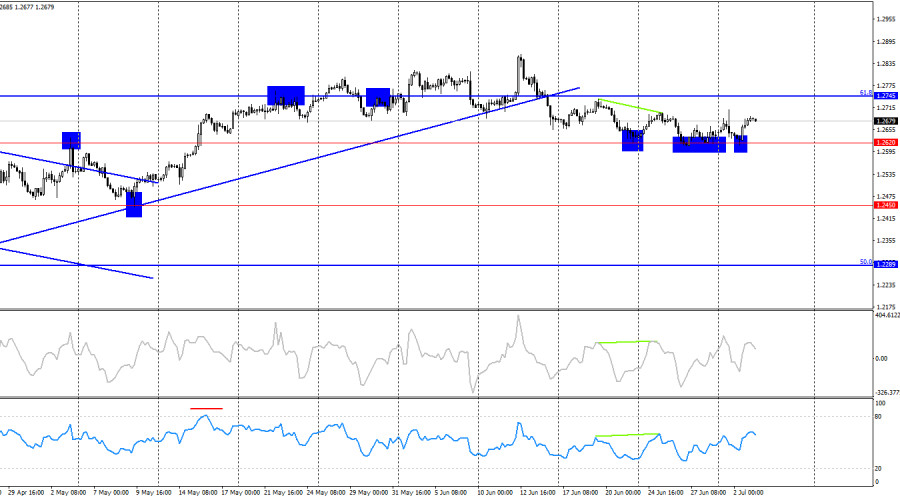

On the hourly chart, the GBP/USD pair rebounded from the support zone of 1.2611–1.2620 on Tuesday, reversed in favor of the British pound, and rose towards the resistance zone of 1.2690–1.2705. A rebound from this zone will favor the US dollar and lead to a new decline towards the zone of 1.2611–1.2620. Consolidation above 1.2705 will allow for continued growth of the British pound towards the next resistance zone of 1.2788–1.2801. Currently, a classic sideways trend is maintained.

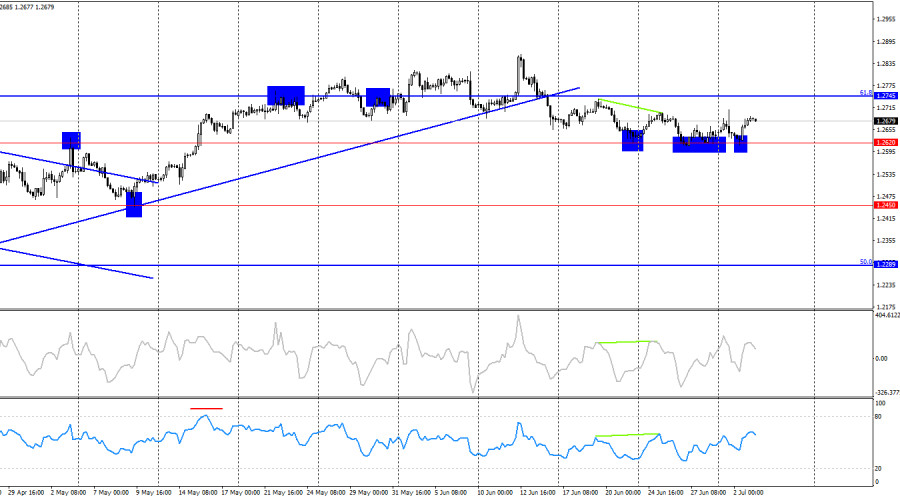

The wave situation remains the same. The last upward wave broke the peak from June 4, and the new downward wave (which has been forming since June 12) managed to break the low of the previous wave. Thus, the trend for the GBP/USD pair has shifted to a "bearish" trend and remains so. I am cautious about concluding the start of a "bearish" trend because the bulls have not completely left the market. The emerging advantage of the bears can be easily disrupted. The 1.2690–1.2705 zone indicates that the bears have slightly better prospects than the bulls, but the 1.2611–1.2620 zone points to another period of weakness for the bears.

The information provided on Tuesday suggested a decline in the American currency. I cannot call it unequivocal since the pair is in a sideways trend. In a sideways market, movements generally do not follow logic and analysis. Nonetheless, yesterday, Jerome Powell indicated that the rate might be lowered this year if the Fed gets evidence that the recent slowdown in inflation is a trend rather than a fluke. Powell's words are a very weak reason to sell the dollar because the initial talk was about five to six rate cuts in 2024. Now Powell is saying that "maybe the Fed will start easing monetary policy." However, as I mentioned, movements within a sideways trend do not follow logic. Yesterday, we might have seen growth due to a rebound from the zone of 1.2611 to 1.2620.

On the 4-hour chart, the pair reversed in favor of the American currency and consolidated below the ascending trendline. However, the British pound has rebounded from the 1.2620 level three times already, indicating the weakness of the bears once again. Consolidation of the pair below the 1.2620 level will allow for further declines towards the next level of 1.2450.

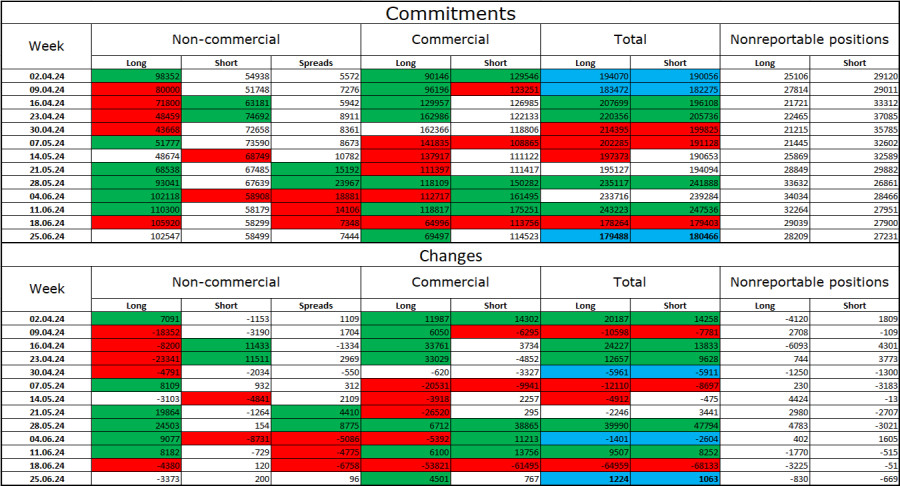

Commitments of Traders (COT) report:

The sentiment of the "Non-commercial" trader category became slightly less "bullish" over the last reporting week. The number of long positions held by speculators decreased by 3,373 units, while the number of short positions increased by 200 units. Bulls still hold a solid advantage. The gap between the number of long and short positions is 44,000: 102,000 versus 58,000.

The British pound still has the potential to fall. The graphical analysis has produced several signals indicating the breakdown of the "bullish" trend, and bulls cannot keep attacking forever. Over the past three months, the number of long positions has grown from 98,000 to 102,000, and the number of short positions has increased from 54,000 to 58,000. Over time, major players will continue to reduce their long positions or increase their short positions since all possible factors for buying the British pound have already been exhausted. However, it should be noted that this is just a hypothesis. The graphical analysis still indicates the weakness of the bears, who have not been able to "take" the 1.2620 level.

News Calendar for the US and the UK:

United Kingdom – Services PMI (08:30 UTC).

USA – ADP Non-Farm Employment Change (12:15 UTC).

USA – Initial Jobless Claims (12:30 UTC).

USA – Services PMI (13:45 UTC).

USA – ISM Services PMI (14:00 UTC).

USA – FOMC Minutes (18:00 UTC).

On Wednesday, the economic events calendar is packed, with the ISM Services PMI standing out. The impact of the news on market sentiment today could be strong in the second half of the day.

GBP/USD Forecast and Trader Tips:

New sales of the pound are possible upon a rebound from the 1.2690–1.2705 zone, targeting 1.2611–1.2620. Purchases could have been considered yesterday upon a rebound from the 1.2611–1.2620 zone on the hourly chart, targeting 1.2690–1.2705. This target has been reached. New purchases are possible upon closing above the 1.2690–1.2705 zone, targeting 1.2788–1.2801.

Fibonacci levels are built from 1.2036–1.2892 on the hourly chart and from 1.4248–1.0404 on the 4-hour chart.