The AUD/NZD cross-pair failed with its attempt to develop an upward trend, but it is actually marking time.

Last week, the Australian dollar strengthened its position by 150 points, reacting to the release of Australian labor market data. The report exceeded all experts' expectations, reflecting the recovery of the Australian economy. The unemployment rate in the country declined to 4.2%, and the number of employed increased by almost 65 thousand. Both components were in the green zone. Inflation did not disappoint the AUD either. The consumer price index in Australia surged to 1.3% in quarterly terms with a forecasted growth of 1.0% and a previous value of 0.8%) and to 3.5% in annual terms with a forecasted growth of 3.2% and a previous value of 3.0%). The core inflation index (using the truncated average method) rose to 1.0% qoq and 2.6% yoy, which is the best result since 2008.

In view of such releases, AUD/NZD rose from the level of 1.0576 to this week's high of 1.0720. However, buyers of the cross-pair failed to consolidate within the 7th mark: the New Zealand dollar does not want to give up without a fight. Traders approached the level of 1.0700 three times this week, but they returned back to the 1.0660-1.0690 range each time. Such price dynamics is due to several fundamental factors.

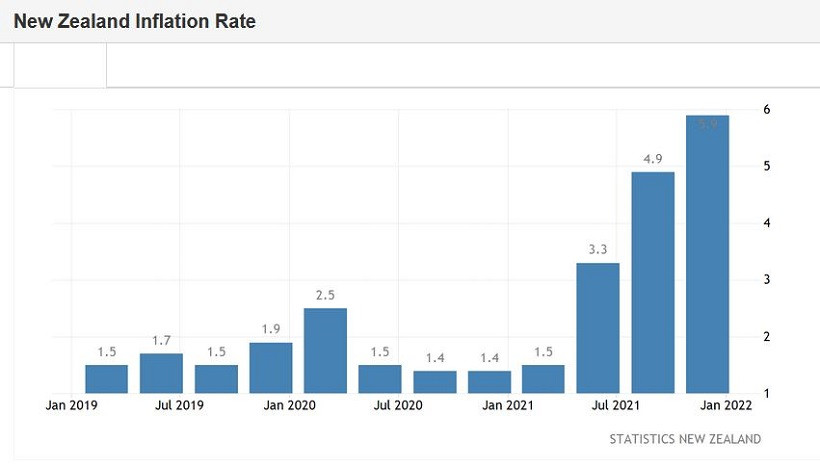

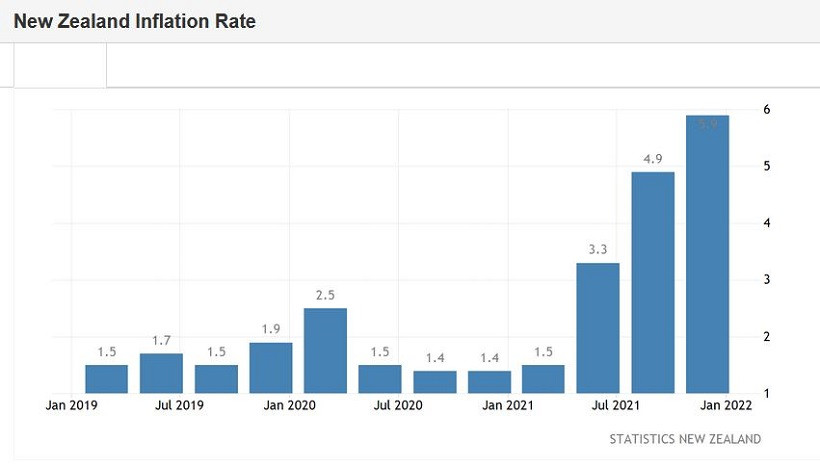

First, the inflation data in New Zealand were published this week. The release favored the New Zealand dollar. Here, the consumer price index rose to 1.4% on a quarterly basis in the 4th quarter of last year, against the expected growth of 1.3%. In annual terms, the indicator has been growing for four consecutive quarters, rising to 5.9% in the 4th quarter of 2021, which is a 31-year high. The structure of this release suggests that prices were rising in all sectors of the economy. High inflation stopped being "temporary", given the pace and duration of growth of the main inflationary indicators.

This conclusion suggests that the Reserve Bank of New Zealand will not only continue to tighten monetary policy this year but will most likely even accelerate the pace of tightening. Meanwhile, the Australian regulator will continue to take a softer and more indecisive position even despite the growth of key macroeconomic indicators.

According to experts from Australia and New Zealand Banking Group, the RBNZ will increase the interest rate at an aggressive pace: from the current level of 0.75% to 3% by April next year. Given the fact that there are 8 scheduled meetings of the Central Bank until April 2023, the New Zealand regulator should not rush in this matter. In turn, Kiwibank analysts suggested that the RBNZ will raise the rate 7 times this year, reaching 2.5% in the first quarter of 2023. This means that the rate will increase at each meeting, including in February. Economists point out that New Zealand's inflation rate is currently twice the RBNZ target range. At the same time, it seems that the consumer price index has not yet reached its peak.

Additionally, representatives of the New Zealand regulator also demonstrate a "hawkish" attitude. In particular, Central Bank's chief economist, Yuong Ha, recently said that the RBNZ will not exclude the possibility of raising the rate under any circumstances. And even the notorious "coronavirus factor" will not become an obstacle to the continuation of the process of tightening monetary policy. It can be recalled here that the Central Bank postponed the rate increase last August 2021 due to one detected case of Delta in the country. But, according to Yuong Ha, the current situation is evidently different from last year's situation, given the coverage of vaccination and the characteristics of Omicron.

Meanwhile, the Reserve Bank of Australia is not in a hurry to take action. A few weeks ago, RBA Governor Philip Lowe ruled out a rate hike in 2022. According to him, corresponding conditions for tightening monetary policy will not be created within this year. He also noted that Australia's inflation outlook is "very different" from that of the US.

However, there were rumors among traders after the release of the latest data on the labor market and inflation saying that the RBA would decide on the first interest rate increase at the end of this year – in November or December. But, this is just an assumption. Philip Lowe can refute these rumors after the results of the RBA's February meeting, which will be held next Tuesday, putting the strongest pressure on the Australian dollar. Secondly, even if this scenario is implemented, the RBNZ will show more aggressive behavior during the year in terms of tightening monetary policy parameters.

All this suggests that the upward pullbacks of the AUD/NZD cross-pair should be used as an excuse to open short positions. If the upward impulse fades in the price area of 1.0700-1.0710 (as happened several times this week), it is possible to sell with the first target at 1.0650 (Tenkan-sen line on the daily chart). The main target is at 1.0610, which is the middle line of the Bollinger Bands on the same timeframe.